Current News

Current News

Happy Holidays to everyone as we wind down 2023. We would like to bring you up to date with news surrounding LIMC including current offerings, settlements, company updates, and interesting news in the life settlement industry.

Company News

We continue to bring to your attention the website and the capabilities it offers to you as clients. As a client of LIMC, you now can login and view your investment(s). This includes your investment payment history to date which reflects your “basis” in each investment, plus any settlements to date represented in active offering. This will reflect your net basis (investment to date less any settlements received).

If we have not created your login to the website, please contact our office and we will send you an email to log in to the website. It will ask for a password and then you will be able to create one for future access. If you are receiving a hard copy of this newsletter, we do not have an email address on file for you. If you have an email and would like to receive email correspondence from us, please call the office so we can update your information.

We would also like to again mention our two new employees this year who have joined the LIMC team. First, Jennifer Finzel, an Executive Assistant, brings experience in executive administration and personal banking. Also, Holly McGinnis has joined LIMC as the Policy Operations Manager. Holly has a strong background in bookkeeping and insurance. We are fortunate to have them join LIMC and please contact them if you have questions regarding your investment.

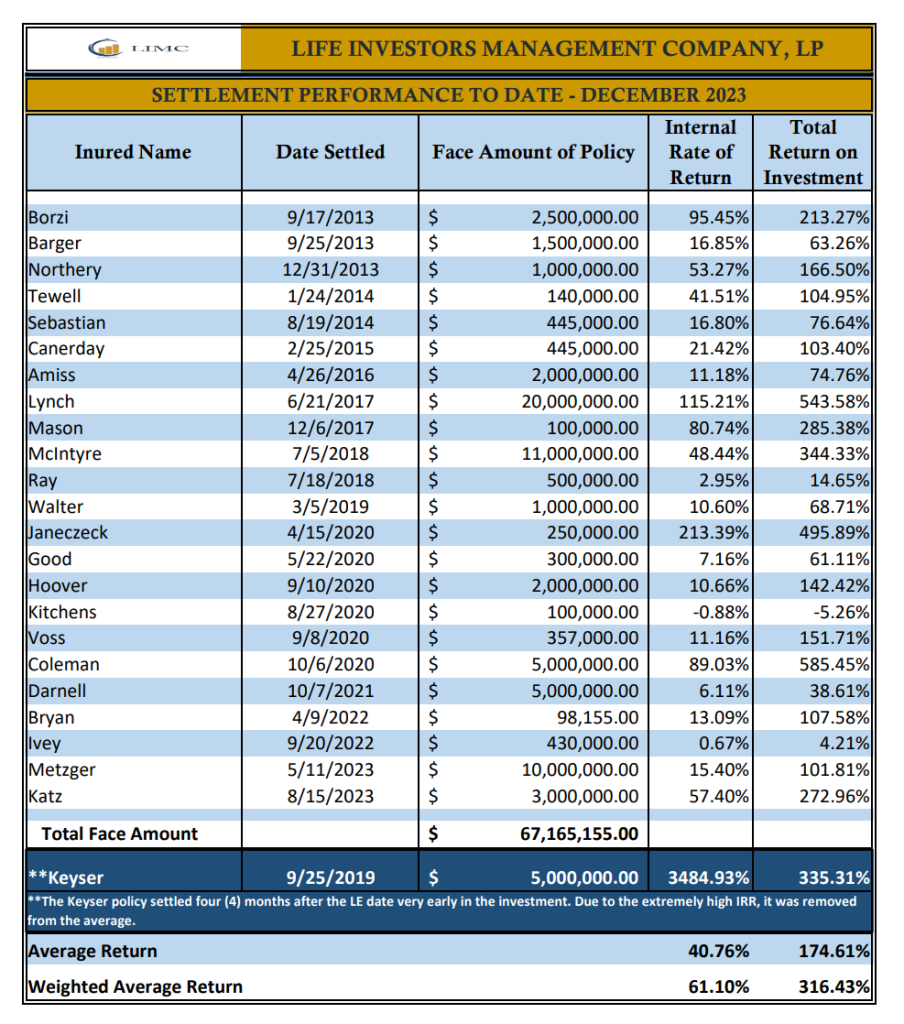

Settlements To Date

Mr. Ray Metzger passed away in May 2023. This policy is part of the Southlake Policy partnerships group. This offering began in late 2017 and the policy itself generated an internal rate of return (IRR) to the investor of 15.4%. Also, Ms. Lois Katz passed away in August 2023. This policy is part of the Destin Policies, LLC and the Keller Policies, LLC partnerships. These offerings began in March 2020. This policy produced an IRR to the investor of 57.4%. Please see below, the performance returns for all policy settlements to date.

Current Offerings

We just recently closed out two investment offerings, however, we are planning to introduce a new offering sometime in late January or early February 2024. Once the offering is ready, we will notify everyone and provide information to those who are interested.

Administrative Changes

Beginning in 2024 As mentioned in our August Newsletter, the cost associated with operating a business has significantly increased in the past few years. To remind everyone of LIMC’s job as administrator or manager of the investment partnerships, please understand, LIMC’s key role is to manage the policies owned by the investment partnerships. This entails invoicing the partner-members their pro-rata share of the policy premiums and making sure the premiums are paid to keep the policies active and in good standing.

Non-paying investor-members put the paying investor members at risk. Per the Operating Agreement of each partnership, it is the Manager’s duty to collect ALL capital calls in a timely manner. It is also the Manager’s duty to foreclose on late or non-paying members and place the forfeited interest with a new, paying member. This ensures that the total annual premium is collected to keep the policy in good standing.

Currently, LIMC collects administrative fees representing an average of .53% of the total net investment of all investor-members in all investment partnerships, well below industry standards. Interestingly enough, several investor-members have expressed disbelief that an administrative fee is charged. There has always been an administrative fee charged, though just in the last year was it itemized on the billing statement. LIMC, as administrator or manager, does not work for free to the surprise of some investor-members. Again, the Operating Agreement of each partnership allows the Manager to charge a reasonable administrative fee. Most investment firms charge a fee equal to 1-2% of assets under management representing industry standards.

Beginning in 2024, LIMC will increase administrative fees. In addition, all late capital call payments will incur a 5% late fee. LIMC has also contracted with a third-party administrative company, Life Investors Settlement Company, LP (LISC) to perform certain administrative duties including but not limited to invoicing and collecting investor-members annual capital call and policy management. We are excited to bring LISC on board and look forward to the enhancements they can bring to the company.

LIMC Company Overview to Date

Assets Under Management

Total Policies:

Total Investment Partnerships:

Total Death Benefit of Policies Under Management:

Total Death Benefit to Investor Partnerships:

Total Settlements to Date:

Average Annualized Return (IRR) of Settled Policies:

108

143

$394,905,172

$357,120,000

24

40.76%